At launch, neobanks disrupted banking with superior digital customer experiences. However, as seen in our previous articles, new pressures have emerged in search of growth and sustainable profitability.

For starters, digital product teams have had to respond to rapidly expanding portfolios, moving from apps that serve singular product offerings to apps which include a wide range of financial products. At the same time, these teams have been tasked with creating both localised and cost-effective multi-market CX strategy as part of efforts to expand internationally. And finally, with more digital customers than ever before, digital product teams must consider the various needs of different customer segments, demographics and behaviours.

On paper, neobanks have been navigating these challenges effectively. Over the past three years we have seen the likes of Monzo, Revolut, Starling, Bunq, N26, Chime, Nubank and others make big profit announcements. However, while traditional banks may have initially been caught sleeping, they are now hot on their heels mimicking the very processes that gave neobanks their competitive advantage in the first place. So what is the next step for these disruptors?

As we will see, there are potential lessons to be learnt from Asian super apps such as Kakao, WeChat and Grab. And, with the emergence of Generative AI and LLMs, huge opportunities to revolutionise customer experience have also emerged. In this fourth and final article on our neobank series, we will look to the future — examining these new CX paradigms and drawing conclusions on how neobanks might want to start thinking about the future.

Consumers are increasingly seeking interconnected digital experiences

Superapps

Trends in personal finance and digital activity are evolving rapidly. Customers now expect a banking experience that encompasses their entire financial life. In response, neobanks are launching more complex financial products and, in the case of Monzo and Revolut, subscription models that include rewards ranging from savings to reading to dating and eating.

Beyond this, consumers are increasingly seeking interconnected digital experiences, whereby their work, social, financial and family lives are connected across digital platforms. This is being fuelled by the fact that consumers are increasingly willing to share personal information if it results in a more personalised service.

Together, these trends have supported the emergence of “superapps”, with some estimates suggesting that 50% of the global population will be using superapps by 2027.

Superapps function as one-stop shops, offering a wide array of services — from daily financial transactions to non-financial activities like messaging, shopping, and entertainment. In a departure from traditional banking models, superapps represent a significant shift in banking service delivery, emphasising a holistic user experience that focuses on customer activity and engagement.

Through a number of examples, including Kakao Bank and Grab, this section will explore the business and digital strategies adopted by superapps and examine what neobanks can learn as a result.

Kakao Bank launched in 2017

Kakao Bank: The world’s most profitable neobank

By leveraging large, existing customer bases, superapps have redefined the economics and business of launching a neobank. Unlike Monzo, Revolut and Starling, who continue to spend millions acquiring new customers, superapps benefit from almost zero customer acquisition cost and unprecedented customer growth resulting in fast profits.

One of the best examples of this has been Kakao, which launched its financial services in 2017. Kakao launched with a classic neobank proposition; focusing on the underserved, minimising fees and digitising previously manual tasks. However, none of this was more important than its parent company KakaoTalk, an instant text-messaging application with 220 million users across South-East Asia.

With access to KakaoTalk users, Kakao Bank experienced record customer growth at almost zero customer acquisition cost. Within 6 months, they had gained 1 million users and by 2020 they had amassed 13 million.

And this cost-efficient approach allowed them to offer cheaper loans than traditional banks whilst earning net interest margins above 2%. In turn, Kakao Bank turned profitable within 18 months, earning seven-fold profit growth in some quarters, and continued to expand its range of financial services, from loans to stock trading and credit card programs.

Grab Digital was founded in 2012

Grab Digital CX Strategy

Whilst superapps might hold a competitive advantage through their existing customer base, integrating financial services into a superapp is a challenge. Where does it sit within our app? Do we need a new tab? Is it more important than our ride-hailing service? These are all questions facing digital teams developing superapps.

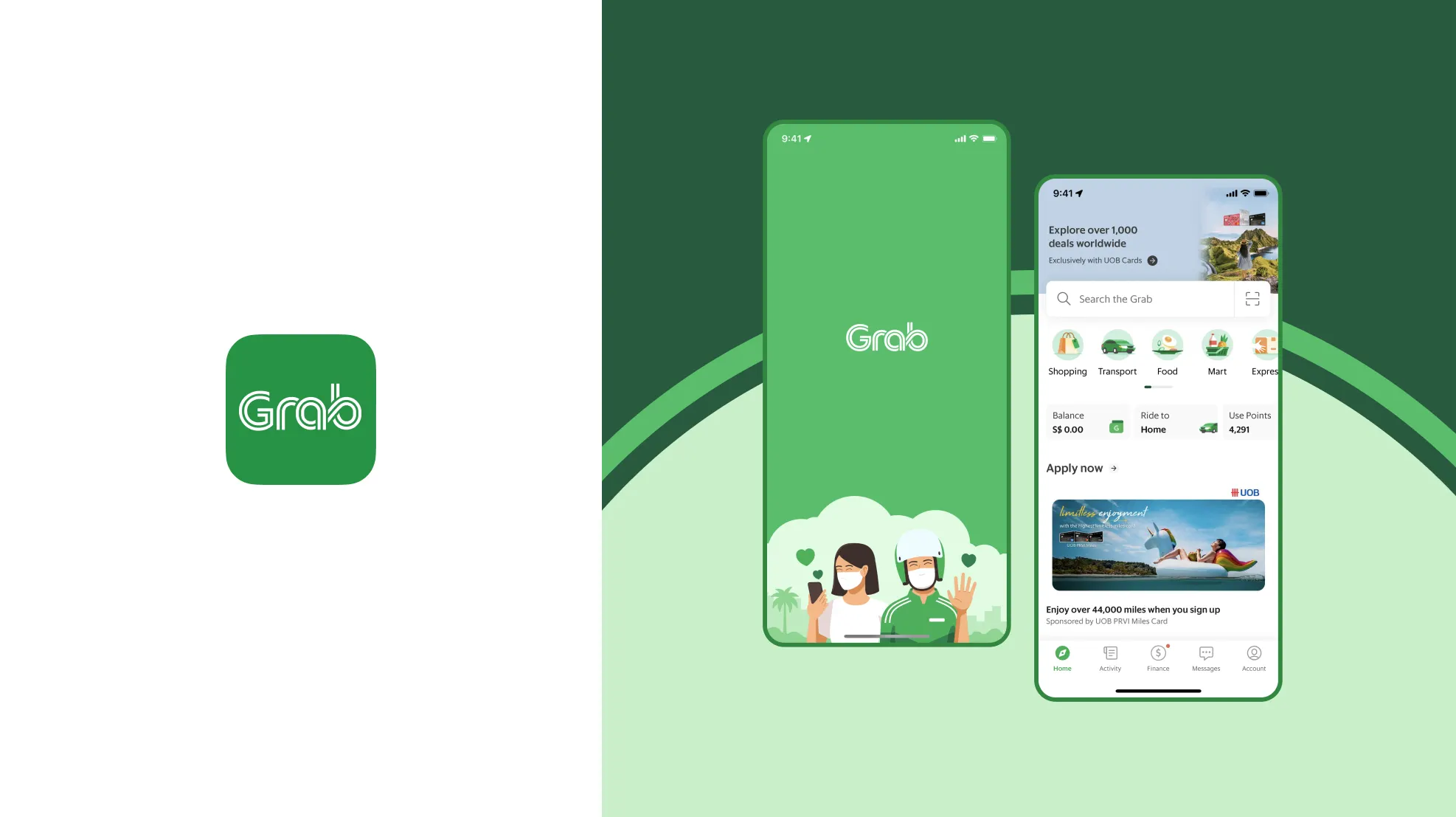

A good example of a superapp navigating this challenge is Grab, a superapp based in Southeast Asia. Founded in 2012, Grab offers a suite of services through its superapp, launching with a ride-hailing service and diversifying to food delivery, package delivery, and, eventually, digital financial services.

From an operational perspective, Grab took two approaches to expanding into financial services, opening its own online-only bank in Singapore and Malaysia whilst acquiring and digitising a small and medium-sized bank in Indonesia. But, when it came to integrating this new offering into the app, Grab’s digital team employed a number of tactics to overcome challenges:

Creating an integrated banking experiences

Fundamental to launching Grab’s financial service offering was adopting a strategy that complements their broad product suite. Their strategy aimed to integrate financial services within their existing services, essentially removing the need for users to have extra bank accounts and apps. In this sense, Grab was not aiming to create a “universal bank”, instead they chose to “use financial capabilities for the ecosystem that Grab has in place”.

In the app, this involves users opening an account and linking it to their payment method for GrabFood, GrabBike, GrabCar, GrabExpress, and GrabMart, among other services. This is a similar concept to Apple Pay or Google Wallet. Here, banking is not at the centre of the superapps experience, instead it enables a seamless and frictionless checkout journey for other products and services (see below).

Grab Digital boasts a broad product suite

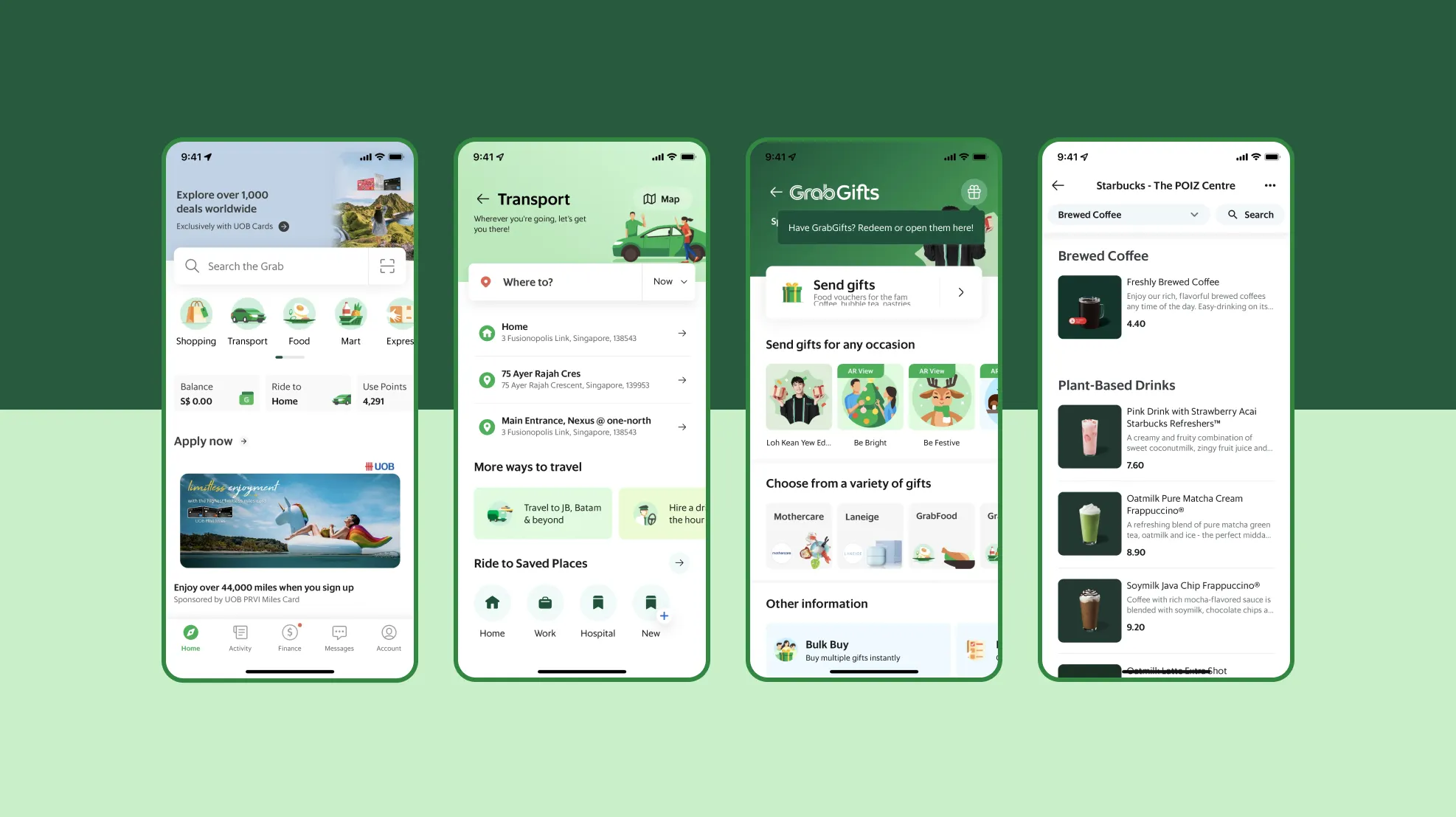

Introducing a ‘Finance’ tab

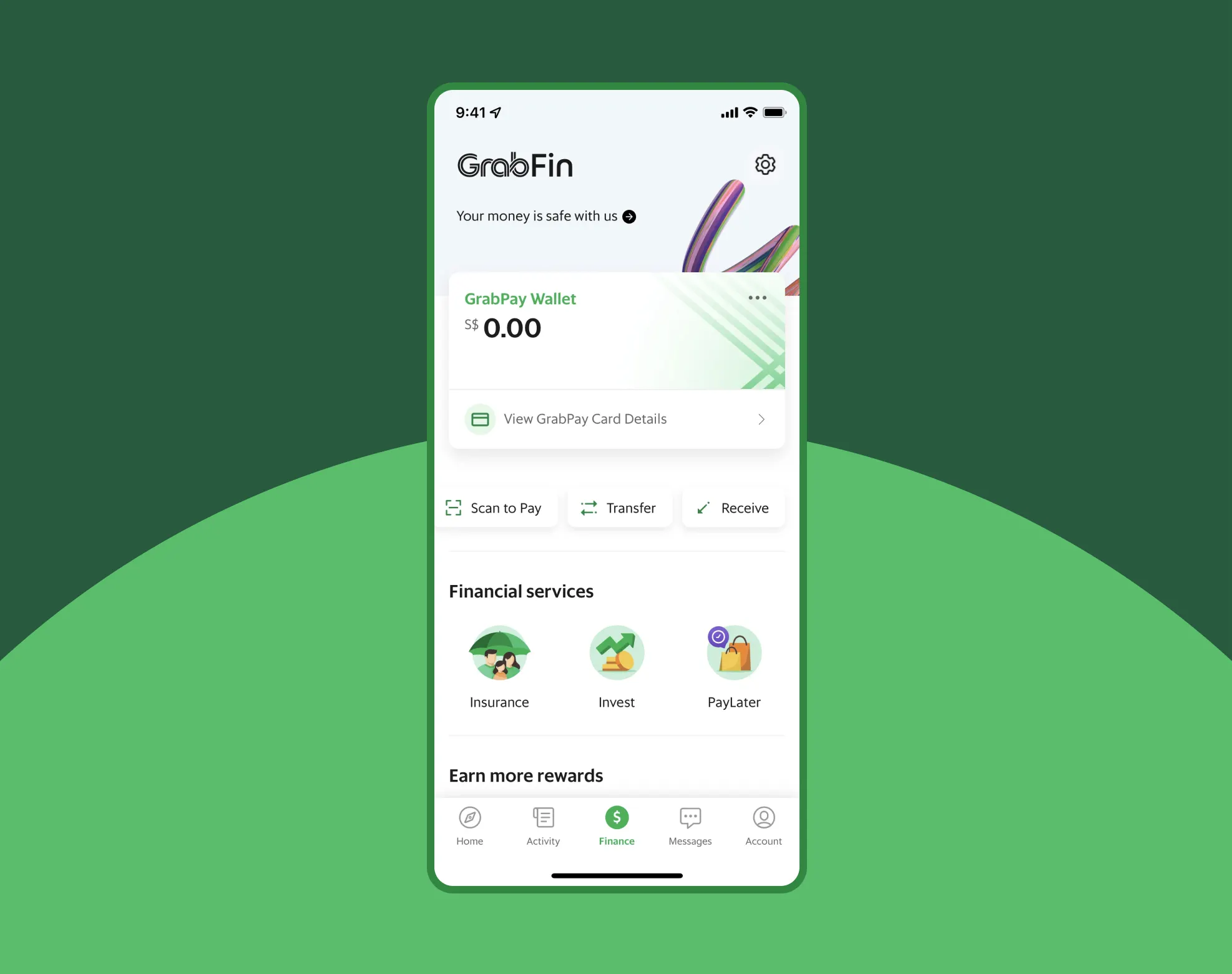

Whilst integrating into existing products and services was key for Grab, they also launched a number of more complex financial products that would be key revenue drivers. For example, they launched insurance, investments, savings and Buy Now, Pay Later. With this added complexity, Grab recognised the need to provide customers with a designated space to manage their finances.

Grab introduced a Finance tab to their customer experience

To support this, Grab introduced a ‘Finance’ tab to the navigation bar. Here, customers can easily view their wallet balances and related actions (Top Up, Scan to Pay, Transfer). At the same time, they have a clear choice of financial services such as Insurance, Invest, PayLater, making it easy for users to access these features. Here, customers can go through more complex journeys, such as onboarding and KYC, that are distinct to the rest of the app.

For neobanks, the immediate lessons to be learnt from superapps, particularly in Asia, might be unclear — ultimately, they do not have the massive customer bases of Kakao or Grab. However, we believe neobanks would be wise to consider the digital strategies of superapps — particularly in focusing on creating integrated banking experiences and managing limited app real estate within a complex multi-product environment.

However some neobanks and other financial services across Europe and the US are in fact adding different products and services to create a more holistic, connected banking experience:

With Revolut’s aim of becoming the ‘all-in-one superapp’, they have recently added more holistic subscription tiers, eSIMs, travel tours and experiences and chat functions.

Revolut and Chase UK’s plans to create targeted advertising propositions for advertisers suggests they see opportunities to integrate and promote non financial services within the app.

American Express and Chase US continue to evolve credit card programs, increasingly offering experiences, travel and rewards from within their own ecosystem.

And, of course, we have seen Elon Musk’s plans for X to replace YouTube, LinkedIn, FaceTime, dating apps, and even your bank.

As this trend continues, neobanks, with their digital-first and agile approach, are uniquely positioned to evolve and adapt. However, at Elsewhen, we believe those neobanks that are at the forefront of change will be the ones to capture the opportunities.

AI Banking

Neobanks have utilised artificial intelligence since their formation, using rules-based algorithms to provide spending insights and to recommend products and services. However, the unique capabilities of Generative AI and LLMs now represent a massive opportunity for neobanks, both in the immediate and long term.

At Elsewhen, we believe the immediate value presented by Generative AI and LLMs is in delivering unprecedented levels of productivity. Financial service organisations, including neobanks, are plagued by monotonous tasks and manual processes. At their core, Generative AI and LLMs, combined with in-house, proprietary data and innovative UIs, are powerful tools for streamlining, augmenting and redesigning these business processes.

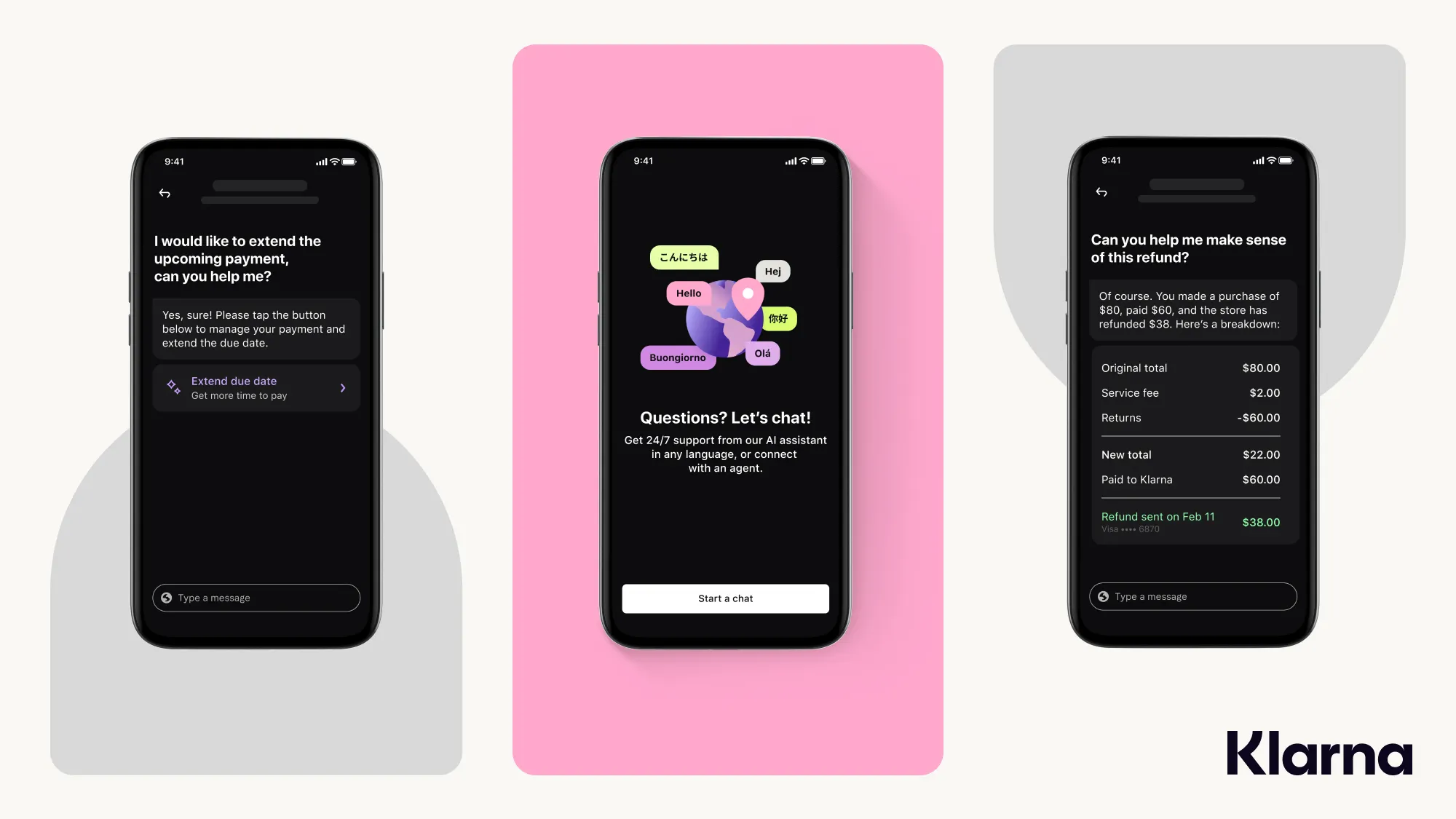

For example, Klarna, the Buy Now, Pay Later (BNPL) specialist, is leading the way for financial services when it comes to their Generative AI and LLMs, with their OpenAI-powered virtual assistant. A recent report showed, since launch, the virtual assistant successfully completed two million conversations; now handling two-thirds of all customer service chats from refunds to disputes.

Klarna’s OpenAI-powered virtual assistant has successfully completed two million conversations.

Sourcewww.klarna.com

“For financial services brands looking to boost productivity without ruining customer experience, this performance must look like the holy grail of chatbots,” Leon Gauhman, Director of Strategy at Elsewhen told The Fintech Times, “Yet it only scratches the surface of Generative AI and LLMs’ potential.”

Klarna is leading the way for financial services with their AI powered virtual assistant

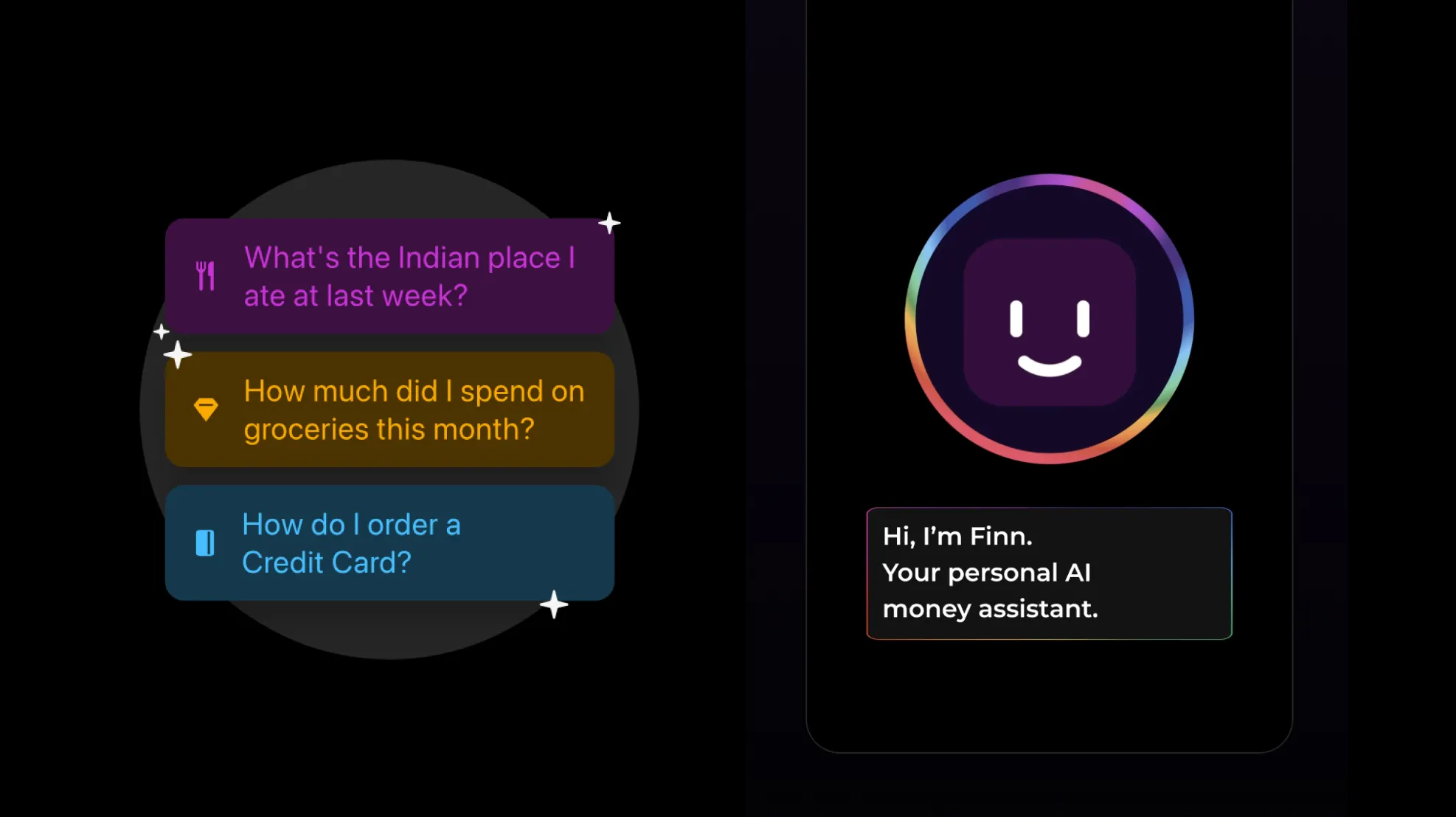

In the neobank world, Bunq has recently updated Generative AI assistant, Finn, to answer back-to-back questions and provide deeper insights into users’ finances at twice the speed. It has now answered more than 100,00 customer questions, solving up to 40% of user support questions.

Bunq have introduced a Generative AI assistant called Finn to the market

However in the longer term, we see Generative AI and LLMs as having the potential to transition neobanks into fully AI-driven platforms, presenting a bold new direction in banking.

Imagine a scenario where the entire banking operation is managed by autonomous agents — systems that will be able to execute multiple steps and act on results with minimal human intervention. AI would handle everything from risk assessment to customer inquiries, all in real-time and with precision beyond human capabilities. This model could completely redefine neobanks operating models and dramatically reduce costs.

From a customer perspective, AI banking could offer completely bespoke financial products and services — such as unique insurance policies — that predict a customer’s life and financial decisions. Meanwhile, AI could be used to build adaptive user interfaces by creating a bespoke app for every single customer based on their behaviours and preferences. Together Generative AI and LLMs can deliver a hyperpersonalised customer experience, addressing the needs of every use context. When it comes to Generative AI and neobanks, we are still very much in the early days.

However, at Elsewhen, we believe that those brave enough to be AI early adopters and who want to supercharge their products and services will benefit the most. Now is the ideal time to perfect the methods, approaches, and skills to create bespoke AI-driven products and solutions.

Conclusion

As neobanks continue to evolve, the path forward involves not just adopting new technologies but also fundamentally rethinking how banking should operate to meet modern customer expectations. Leaders in this space must stay ahead of technological advancements and be willing to disrupt traditional models courageously. At Elsewhen, through a wealth of experience helping financial services deliver digital products, strategy and transformation, we are uniquely positioned to help organisations achieve this. Get in touch to find out more.

References

Revolut Ultras

Monzo Plans

What is a Superapp?

Kakao Bank: World’s Most Profitable Neobank

(https://uniteconomics.substack.com/p/kakao-bank-worlds-most-profitable)

The South Korea Experience: How Kakao Bank forced traditional banks to buck up

Grab COO Alex Hungate on the future of finance

(https://www.grab.com/sg/inside-grab/stories/alex-hungate-future-of-finance-nikkei-interview/)

Superbank integrates banking services into Grab to provide Indonesian users with improved financial inclusion

Revolut moves closer to superapp status

(https://sifted.eu/articles/revolut-super-app-travel-experience-bookings-news)

Revolut & Chase: The retail media boom comes to banking

(https://www.warc.com/content/feed/revolut--chase-the-retail-media-boom-comes-to-banking/9414)

Elon Musk’s ‘everything app’ plan for X, in his own words

(https://www.theverge.com/23940924/elon-musk-x-twitter-all-hands-linda-yaccarino-super-app)

Klarna AI assistant handles two-thirds of customer service chats in its first month

Bunq launches beefed-up AI chatbot 0.2 and confirms re-applying for US banking licence after withdrawal

Chat GPT Plugins – Who Are the Winners and Losers From OpenAI’s Latest Game-Changing Innovation?