Our client, a leading independent private equity firm, works to build a portfolio of high-growth, sustainable businesses that deliver a compelling proposition – supporting them with expertise and capital to drive growth.

The firm saw the opportunity for a new finance management platform for SMEs, giving a clear end-to-end overview of cash flow – and providing access to a full range of tailored financial services. They engaged Elsewhen to work on a proof-of-concept, developing a business case and prototype for a new SME-targeted financial platform – in terms of a value proposition, service design and technology strategy.

To build the business case, we researched market sizing, customer needs, competitor landscape, and possible opportunities. We decided to focus this platform on the financial management needs of larger SMEs with significant turnover, complex cash flow and in-house finance staff.

We worked closely with the firm, building out a value proposition, service design and user interface concepts – to show that the platform idea had the potential and value to be taken forward to market.

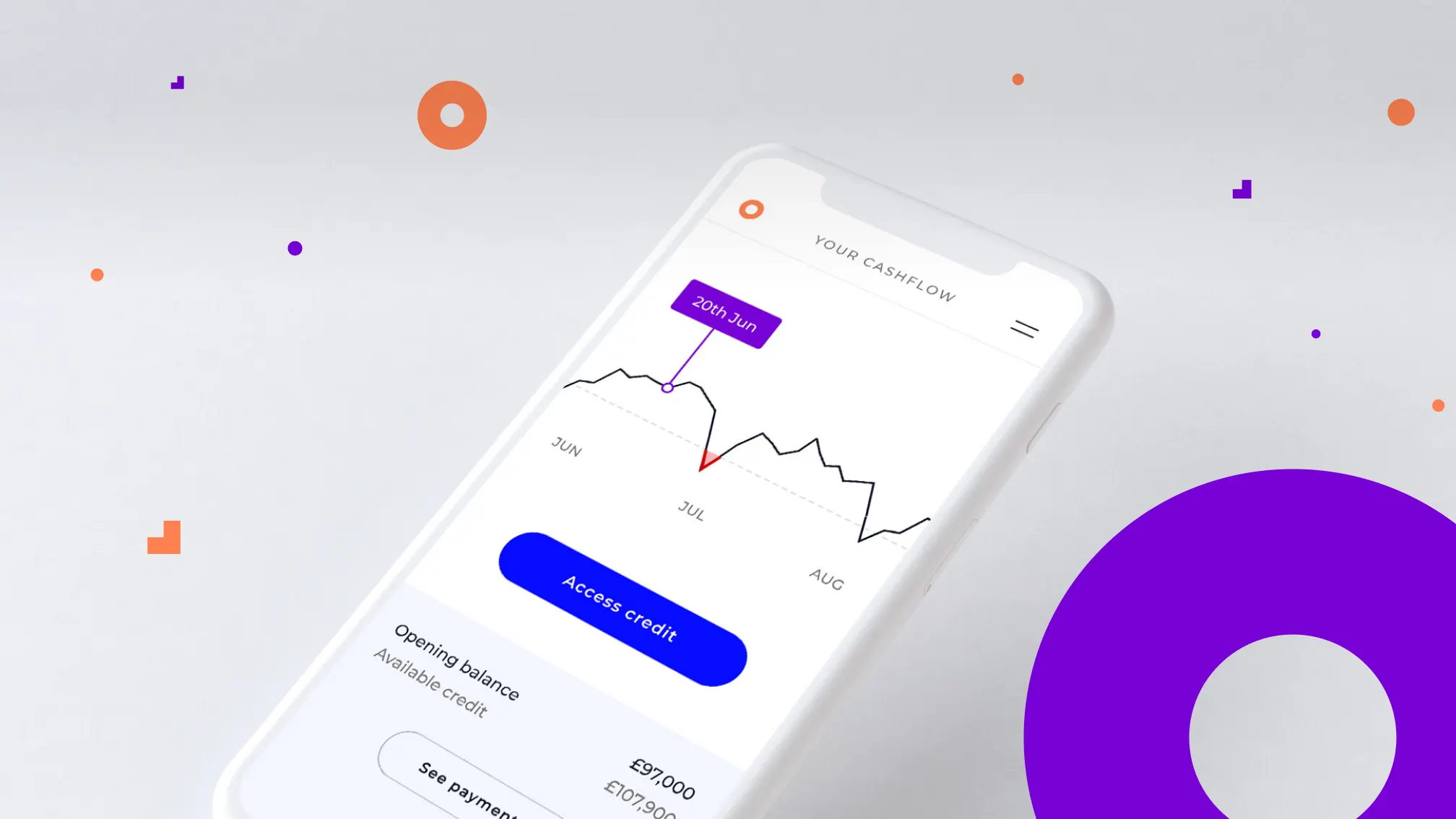

Our design team visualised a prototype solution for a digital ‘one-stop-shop’ for SME banking and finance. We also identified, assessed and shortlisted technology partners and financial service providers who could enable the platform's core functionalities.

Elsewhen designed and developed a viable proposition to bring to market and evolve with ready customers: We delivered a full proof-of-concept, design and product strategy, as well as a project wiki recording the insights captured during the discovery process, competitor research and user testing: We defined and designed the minimum viable product (MVP), with the initial core user journeys – based on the identified market needs. Our team also developed a complete product brand with an Implementation-ready design system.

The firm was extremely satisfied with the proof-of-concept, design and accompanying branding created for the platform. With a solid business case, they are now equipped to tap into this new opportunity.

The new platform will enable SMEs to see their financial future more clearly. They will be able to take action to avoid running out of cash, easily changing a payment date or amount – while gaining access to credit, loans and other tailored financial services at the right time.